Everything you need to know about Etsy Canada’s fee and taxes!

A lot of people think selling on Etsy is too expensive as a Canadian. It doesn’t have to be if you understand the fees and price your listings accordingly. My Ultimate Canadian Print on Demand Pricing Calculator, takes into account every single factor and fee that you need to consider when pricing your items and determining your profit margins. If you haven’t opened your own Etsy store yet, use my link to get 40 free listings: https://etsy.me/3uQ6Q3A

Today I’ll walk you through the Canadian Etsy seller fees, how they are calculated, and when they apply, as well as how Canadian taxes work on Etsy. Grab yourself a snack, and let’s get to reading or watch this video for a rundown on how taxes and fees work

Etsy Seller Fees

The basic Etsy seller fees include:

- a listing fee (paid when you post an item for sale and every time an item listing renews – aka every time you make a sale)

- a transaction fee (think of this like a commission every time you make a sale)

- payment processing fees (all credit card readers in today’s age charge businesses a flat rate – usually a few cents – plus a percentage – aka commission – on every transaction)

- an operating fee (think of this like a tax that gets charged on your sales)

- a one time setup fee to open your store

Ready to open shop? Get 40 free listings when you use my link to signup

Etsy Fee Type | Cost and Fee Structure |

|---|---|

Listing Fee | $0.20* USD (even for Canadians) |

Transaction Fee | 6.5% of the total transaction (cart items – discounts + shipping) |

Payment Processing Fee | $0.25 CAD + 3% of the total transaction (on CAD and USA orders only) sales made to customers outside CAD/USA incur a 4% transaction fee instead of 3% |

Regulatory Operating Fee | 1.15% of the total transaction (cart items – discounts + shipping) |

Etsy Setup Fee | $15.00* USD one time setup fee charged when you open your store |

Currency Conversion Fee

So this is where everyone gets stuck. A common question from Canadian sellers is “should I list my items in USD or CAD?”. The answer is hands down, no debate CAD. Let me state that again: if you are a Canadian, list your items in Canadian Dollars.

Why Kathy?

Why?! Etsy charges a currency conversion fee if you list your items in USD. That’s an additional 2.5% fee on top of every sale

“But what if I want to charge $32.99 USD for my t-shirts? Won’t they see it as $32.98 and $33.01 and such on different days?

Yes, but who cares?

Okay so YOU care. I know, I know, I was once in your shoes, so let me tell you this: I know you *think* you’re thinking about your customers, but as an experienced Canadian seller once told me “most of my customers are American and it doesn’t seem to matter, they don’t look that hard at the prices”. LOL interpret that however you need to, but it’s what got me unstuck on this issue. (I did waste a lot of time switching to USD and then switching back and generally just focusing on stuff that doesn’t matter at all, in terms of making more sales).

I don’t think I need to continue but here’s how the currency conversion fee is charged in case you just need to know.

How Etsy Currency Conversion Fees Work

Currency conversion fees only applies in this exact circumstance: you have set your listing currency or “store currency” to USD when you are in fact Canadian. And don’t try sneaking around it with a US bank account.

If you list your items in CAD, you can forget you ever heard about currency conversion or foreign transaction seller fees.

Unless you have or intend to register your business in the US, set your currency to Canadian. I promise that if most of your customers are US based, you will still reap the benefits of that sweet sweet US dollar.

Continuing down the rabbit hole of being Canadian but choosing to list that tshirt for $32.99 USD, Etsy will charge you a 2.5% conversion fee on every transaction (cart items – discounts + shipping), so your transaction fee may as well be 9% (source).

Canadian Taxes for Canadian Etsy Sellers

This is another one new sellers get stuck on. Luckily I have all the answers and new sellers listen up: if you are a brand new seller or new business you are what we call a “small supplier” in Canada and it fucking brilliant. If your business does less than $30,000 in sales every 12 months, you get to forget about collecting or remitting taxes. I’m not joking.

I love this exemption because it allows new businesses and entrepreneurs to focus on doing their first $30,000 year without worrying about registering or collecting GST/HST*. Knowing what I do now about how Etsy handles Canadian taxes, I wish I had stayed unregistered.

*In this article I will continue to use “GST” to also refer to HST and QST which replaces the 5% GST rate in some provinces and territories.

If you are registered to collect GST, jump down to the GST Registered Seller section. But I promise, Etsy is much easier if you don’t register for as long as possible 🙂

When Does Etsy Collect (and Remit) Taxes for Me?

Etsy will charge Canadian customers GST in the following situation only: if you are NOT REGISTERED to collect GST and do not have a GST ID number.

Wait, that sounds backwards?

Stay with me here…

If you are NOT REGISTERED to collect GST, Etsy adds the applicable taxes to Canadian customer’s purchases so they can collect and remit GST for you. When Etsy charges Canadian customers taxes, Etsy is collecting (and therefore remitting) the tax for you

But wait, didn’t you just say we don’t have to worry about tax until we surpass $30,000?

YOU don’t! Let Etsy do the hard lifting of determining what taxes to charge and how to remit them for as long as possible because once you ARE REGISTERED to collect GST, Etsy stops charging customers GST and it gets a little complicated.

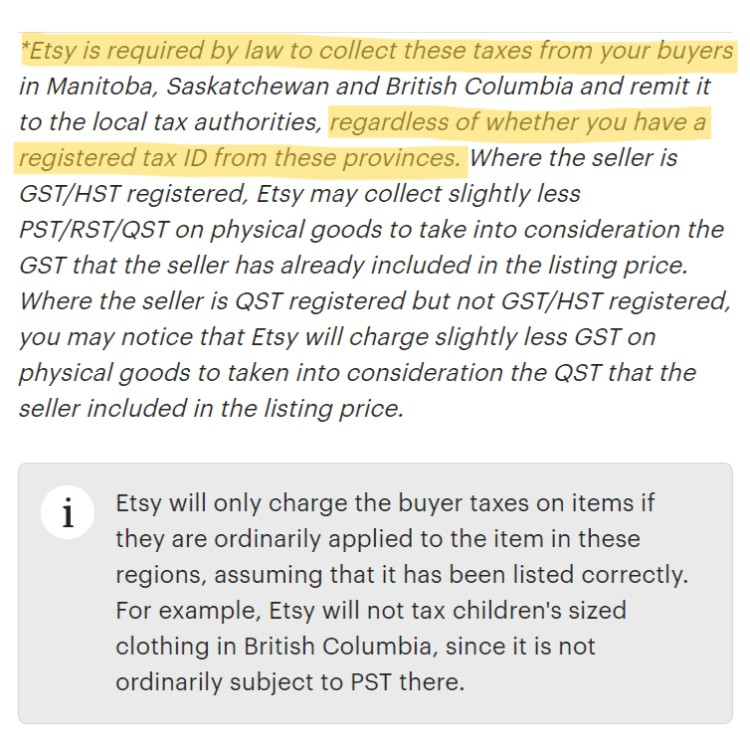

Etsy also collects and remits provincial sales taxes (aka retail sales tax in Manitoba) regardless of whether you are registered to collect (and remit) these types of taxes.

When Doesn’t Etsy Collect and Remit Tax for Me?

Once you ARE REGISTERED and have a GST ID number, Etsy no longer charges Canadian customers applicable GST taxes. Instead Etsy expects you to collect the taxes yourself by factoring them into your listing prices.

Wait…Wtf? I know. (just wait till you tell your accountant)

For GST Registered Canadian Etsy Sellers

Once you surpass $30,000 in revenue over a 12 month period, you are required by law to register for a GST ID number.

If you have a GST ID number connected to your Etsy account, Etsy assumes you are responsible for collecting and remitting applicable taxes on your sales and no longer charges Canadian customers the applicable GST tax. Instead, Etsy expects you to “adjust your listing prices to collect any required taxes, then remit it to the appropriate tax authorities” (source).

This is frustrating because the applicable GST/HST/QST rate varies depending on the customer’s province

Additionally, there is no easy way to “separate out” the tax or see how much tax we *should* be collecting and remitting from each sale (and it wouldn’t be too hard for Etsy to build in those kinds of reporting features).

In all seriousness, Etsy is suggesting you increase your prices by 5-15% or risk losing up to 15% of your profit (15% is the highest possible GST/HST/QST rate in Canada).

As a Canadian, I have a soft spot for my fellow Canucks and accept that I make a much smaller profit on all my Canadian sales, but I do have a Canadian seller hack that I use to help recover the lost revenue.

Instead of increasing the listing price by 5-15% percent to collect the required GST/HST/QST, I increase my Canadian shipping prices to increase the total value of my Canadian sales.

-Kathy on Increasing Prices to Collect Tax

This is by far the best way to “collect tax by including it in the listing price” if you need to collect and remit a portion of your sales as GST when Etsy doesn’t do it for you.

Do You Need to Collect and Remit Provincial Tax?

The whole “including tax in the listing price” is also frustrating because *technically* as a Canadian, you may need to register to collect provincial sales taxes based on the province where the goods are delivered. No, not just your home province, but ANY province where your customers live that have provincial taxes (this would include BC, Manitoba, Saskatchewan and Quebec). If that’s news to you, I’ll link the requirements for supplemental reading.

I say *technically* because Etsy does collect and remit provincial sales tax for you, regardless of whether your registration status in that province (source). So if you’re only selling on Etsy, do you really need to register to collect and remit provincial sales tax? 👀

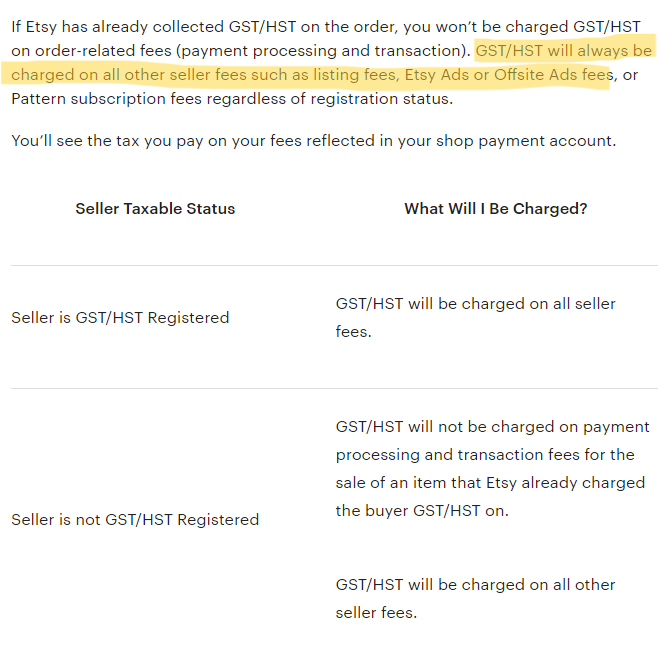

Does Etsy Charge Tax on Seller Fees?

I can just imagine the look on your face right now. I really wish I could unlearn this one, but I do my own taxes after all… Before you get in a panic, remember that GST registered sellers can claim tax credits (any GST paid on your business expenses) against GST owed. One joyous thing about doing the collection and remittance tax dance is that collecting GST from your customers as a percentage of your sale, allows you to “deduct” GST paid on business expenses.

Thanks to a big change in how Etsy operates in Canada (as of July 2022) Etsy is required to charge GST on listing fees for ALL sellers. For new sellers this will only apply to your listing fee. If you ARE REGISTERED for GST, Etsy will charge GST on all three Etsy fees mentioned above (a listing fee, transaction fee, and payment processing fees)